Keeping connected and in control

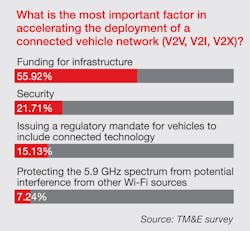

2014 has seen a government and auto industry cooperative effort to develop connected vehicles (CV), which may well lead to an explosion in public attention to intelligent transportation systems (ITS).

According to Thomas Kern, interim president and CEO of the Intelligent Transportation Society of America (ITS America), “We’re going to reach a tipping point. Automakers tended before to hold their ITS know-how close to the vest, [but now] the trickle-down is becoming a flood.”

Government participation is helping to convince automakers to forge ahead with their own plans for partly automated and autonomous cars. In just the past year, several groups have been launched that are dedicated to ITS development via government/private partnered enterprise. The National Transportation Operations Coalition (NTOC) is an alliance of national associations, practitioners, and local, state and regional groups seeking to improve the operations of the nation’s transportation system. The National Operations Center of Excellence is a triad composed of the American Association of State Highway and Transportation Officials (AASHTO), ITS America, and the Institute of Transportation Engineers (ITE) formed, in collaboration with the U.S. DOT, to aid regional, state and local transportation officials in adopting and managing ITS technologies. Collision Avoidance Metrics Partnership (CAMP), a group of eight international automakers, including three from the U.S., have been working with the University of Michigan Transportation Research Institute (UMTRI) under the U.S. DOT-sponsored major Safety Pilot Connected Vehicle research and demonstration project in Ann Arbor, Mich.; moreover, MTC Leadership Circle, a public/private research-oriented partnership of the Michigan DOT, three Japanese automakers, two U.S. automakers and seven other companies, advocates for the new Mobility Transformation Center being built next to UMTRI. The MTC will develop a system of connected and automated transportation to be tested on the streets of southeastern Michigan through 2021. The ITS Deployment Coalition (IDC) is a group of public and private stakeholders that identify means for deployment of ITS technologies integral to operation of V2I communications. Finally, Western Road User Charge Consortium (WRUCC), a coalition of 11 western state DOTs, has begun exchanging information concerning the development of plans to replace state gasoline and diesel fuel taxes with a tax based on vehicle miles travelled, exemplified by the structure already in place in Oregon.

The biggest spark has been provided by the U.S. DOT’s connected vehicle program, which has rapidly turned ambitious research into the early seeds of deployment. Expanded testing of vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) signaling, known as Dedicated Short-Range Communications (DSRC), sends drivers a fast warning of sudden road and street hazards, such as panic-breaking by a vehicle ahead. The signals come from vehicles ahead of the receiving car, often the crash vehicle itself. Drivers can then take quick action to avoid a crash, or the vehicle might be equipped to apply the brakes or steer around trouble all by itself.

The National Highway Traffic Safety Administration (NHTSA), which is in charge of the government’s regulatory command of the V2V program, issued an Advance Notice of Proposed Rulemaking in August, and is expected to issue an ensuing Notice of Proposed Rulemaking in 2016 and, later, publish a final rule that will give a green light to automakers to forge ahead with CV-ready car development and set deadlines for doing so.

One automaker has decided not to wait for more federal prodding. General Motors Corp. CEO Mary Barra stunned those attending the ITS World Congress in Detroit last September when she announced that buyers of the 2017 Cadillac CTS would be offered advanced automated-vehicle technology called Super Cruise, a new version of adaptive cruise control, featuring hands-off lane-following, braking and speed control in certain highway driving conditions. “A tide of innovation has invigorated the global auto industry,” Barra said, “and we are taking these giant steps forward to remain a leader of new technology.”

Toyota, meanwhile, says on its website, “Our ultimate goal: zero casualties from accidents.” The company has spent more than 10 years researching how to provide drivers and vehicles with V2V and V2I-type information, Hedeki Hada, general manager for electronics systems at Toyota, told TM&E. The company’s approach involves integrating safety devices, which include radar cruise control, lane-keeping assist and lane-departure alert, blind-spot monitoring, pre-collision warning and brake assist for avoiding rear-end collisions and striking pedestrians, and navigation control that provides stop-sign information.

While UMTRI has begun to turn its attention to V2I communication, and is taking some large state DOTs, such as Virginia, Texas and California, along for the ride, automakers, for their part, are going even further toward adding new automated features to their cars that allow them to make collision-avoidance moves without any CV signals from other vehicles. Of course, the most advanced research in this area involves the autonomous vehicle (AV), which would totally drive itself and take any necessary crash-avoiding action. Google is at the forefront of this activity, but automakers are working on their own AVs, picking up on research by GM and others in past years.

Yet despite GM’s announcement, automakers for the most part aren’t talking publicly about their new efforts. But, Debra Bezzina, project manager for the Ann Arbor Safety Pilot, told TM&E, “connected vehicle technology is just a steppingstone toward automated vehicles.” In other words, the two paths will have to merge into one safety system, a supposition given credence by Toyota’s Hada, who said he thinks that both CVs and AVs are “close to deployment,” a statement bolstered by Toyota’s research into a Lexus model self-driving vehicle equipped with a laser system that can detect objects up to 230 feet away, radar on the front and sides, and high-definition color cameras.

Progress proceeds with caution, nonetheless, with GM hedging its bets on what promises its CV development can make. GM spokesman Daniel Flores told TM&E that although a modified GM Chevrolet won a government-sponsored AV competition in 2007, it’s far easier to build a prototype AV than a commercial vehicle that can drive safely in a city environment. “We’re going to need several leaps in technology before we get to the point that an autonomous vehicle can drive itself under all conditions,” Flores said.

Economy building

The office of Greg Winfree, U.S. DOT’s Assistant Secretary for Research and Technology, has been pushing state and city transportation authorities to delve into creating integrated corridor management (ICM), in effort to develop economies along busy highway and transit corridors.

According to Winfree, there are “hundreds” of potential ICM candidates in the U.S., a view supported by Nick Compin, senior transportation planner with the Calif. DOT (Caltrans), who told TM&E, “You’re going to see a lot of ICMs” in the near future.

Leading the charge and aided by federal money are three “Pioneer Sites” cities—I-15 in San Diego, U.S. 75 in Dallas, and I-394 in Minneapolis—all three of which did studies showing that ICM will increase mobility while reducing travel time, delays, congestion, fuel consumption and emissions. Deployment in Minneapolis has been delayed by dry funding, but it is expected that a healthy transportation bill in 2015 would get all three corridors into full development.

On the heels of these successful developments, DOTs in Washington state, California and Florida are presently working with the U.S. DOT to develop ICMs of their own. “We’re definitely getting into it,” Florida Secretary of Transportation Ananth Prasad told TM&E, though the DOT is sticking to highways for now and isn’t ready to include transit just yet.

Collating data

State DOTs are relying increasingly on traffic data collectors such as INRIX, Waze and HERE for reports on traffic flow and related information, and are getting more aggressive in how they disseminate that data to motorists.

Last October, Waze began a new program under which it agreed to provide its data on traffic congestion and other traffic events to state DOTs or other transportation authorities, which would “pay” for that data by giving Waze all the similar data that it collects via road sensors, cameras, etc. An information exchange, basically, designed to disseminate and collate data. A seeming win-win situation. Waze relies heavily on reports from motorists who come across road events, some by social media. The Waze website proclaims to users of its app: “It’s like a personal heads-up from a few million of your friends on the road.” The program involves 20 DOTs or other transport authorities in the U.S. and abroad, including authorities in the cities of Sydney, Boston, Los Angeles, Rio de Janeiro, Barcelona, Jakarta, and Tel Aviv, as well as the states of Florida, Washington, New York, Iowa, Kentucky and Oregon. States use a variety of methods for collecting data; e.g., the Texas DOT has its 7,000 dump truck drivers “crowd source” their data, relaying it back to the state traffic control center. Waze can bolster its data network by incorporating this information.

As for disseminating information to motorists, states increasingly are expanding the old 511 program to include variable message signs that give travel time updates, real-time website information on traffic jams, and radio reports and use of social media to both get the word out and gather data from motorist smartphones. And while websites remain a popular method of communicating up-to-the-minute information, some states are currying web use into the world of apps. To wit: the Montana DOT recently began offering a free app that provides information on road conditions, weather, road closures and incidents, as well as highway camera images, which are especially welcome for winter mountain travel. Other state authorities are taking notice. Don Hunt of the Colorado DOT foresees a massive consolidation of all modes of communication. “All of that information will [eventually] wind up in the cockpit of your car,” Hunt told TM&E.

Expanding ATMs

Some state DOTs, notably Caltrans and Florida, are starting to install active traffic management systems (ATMs) on certain highways in their states, following the lead of Minnesota and Washington, which have had ATM systems for several years. These systems, which have been common in Europe for some time, usually consist of variable overhead signs that signal that a lane has been opened or closed, and change speed limits for each lane based on traffic flow on that lane.

Oregon has installed a similar system on State Hwy. 217 in southwest Portland. Also, periodic gate closures control the flow of traffic into and out of the median parking area at Multnomah Falls, east of Portland; the traffic making a left turn onto the eastbound lane of I-84 into busy traffic is regulated to prevent accidents. And in Redmond, traffic lights on U.S. 97 are equipped with adaptive controls, which change the timing for green and red lights according to traffic flow.

Another popular means of controlling traffic flow is by creating high occupancy toll (HOT) lanes, with motorists paying a changing toll, an amount based on whether traffic is light or heavy. HOT express lanes were opened recently on I-95 in Maryland and Virginia, and along highways in Bellevue, Wash., Broward County, Tx. and California. HOT express lanes are planned for I-77 in Charlotte, N.C., while the Florida DOT lists eight express lane or toll-road projects expected to go “live” by 2017. HOT lanes and other tollways are seen as methods of assuaging dwindling federal funding and averting an increase in the gas tax.

Oregon is set to also start a pilot program on July 1 with 5,000 volunteer motorists paying a per-mile tax of 1.5 cents instead of the 30 cents per gallon gas tax. States such as Illinois, Florida, Vermont and Massachusetts have voiced interest in Oregon’s new system, which may signal a more pervasive application as the coming year plays out. An alternate plan has rolled out in Texas, which is using part of its tax on oil and natural gas to net $1.7 billion for transportation through Aug. 31, and Virginia will persist with its 2013 replacement of gasoline and diesel tax with wholesale taxes on gas (3.5%) and diesel fuel (6%).

Car sharing and more

The advent and proliferation of car sharing services and smartphone-oriented rental and taxi services has begun to register a significant impact on how large cities are adapting to commuter traffic. Zipcar has more than 10,000 cars in its general fleet, which are available by the hour or day, and uses parking “pods” purchased from a given city by which to service its customers. In Chicago, for example, the company owns about 700 cars and has about 300 reserved locations. The company’s goal is to have parking spaces within a five to 10 minute walk from a customer’s location. Likewise, in Washington, D.C., about 375 parking locations are available to Zipcar.

Ride-sharing services, dominated by three San Francisco startups—Uber, Lyft and the smaller Sidecar—have quickly become a very profitable multi-billion dollar industry estimated to serve 250 cities in 50 countries. These outfits use computers, smartphones and GPS to link up drivers with their customers, promoting the comfort of “friends driving friends.”

Drivers choose their own hours and agree to go anywhere. Passengers benefit from costs often 20% lower than taxicab prices. But media news articles in recent months, mostly targeting Uber, have recounted accusations of misconduct by drivers and alleged invasion of some persons’ privacy by tracking their travel habits. Yet despite these concerns, and the legal implications associated with them, ride sharing services continue to boom.

So what does it all mean? Where is this pointing to? Provided present patterns persist, it would seem that ITS will see further metropolitan entrenchment throughout the year, and while deployment of any large-scale infrastructure system takes time and perhaps more money than is presently available, the public’s interaction with ITS presently in operation indicates that the state of the ITS industry is strong. TM&E

And the survey says …

What you told TM&E is and isn’t going to matter in 2015

TM&E’s annual State of the Industry survey results are in, and while the results weren’t as surprising as we had expected, they do bear out in some interesting—and perhaps unforeseen—ways.

The intelligent transportation system (ITS) industry is making steady gains, most notably in highly populated areas, a fact that stands to reason as it behooves those who direct the application of funding to affect the lives of as many people as possible. And yet, recent concerns over what will or will not constitute federal funding in the coming years—concerns that have approached levels of apoplexy—seem to have left little residue when it comes to what our readership’s expectations are for 2015.

Nearly 60% of respondents expect to receive about the same amount of overall funding as in 2014, and more than 50% expect ITS specific funding to likewise remain the same. Even though one-third of respondents have a bad feeling about the odds of long-term legislation after MAP-21 expiration, there seems to be faith, or perhaps merely calculated betting, that funds will somehow come from somewhere. The slow rise of P3s may partially explain this, but it by no means accounts for such a dissonance.

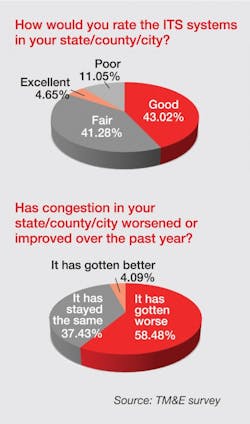

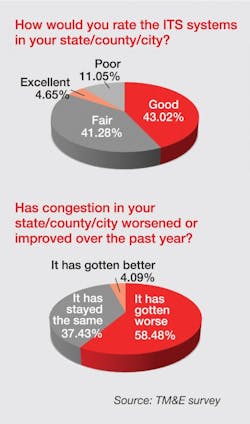

While congestion seems to be growing worse, or at least staying as bad as ever (96% combined response), present ITS systems are thought of as good (43%) or fair (41%). So if that’s true, what is really needed coming into the new year?

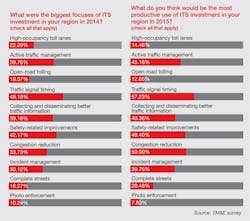

Well, survey says … traffic signal timing (57%), safety improvements and congestion reduction (50%) and active traffic management systems (45%). These are all major infrastructural demands, so the question is can a return to 2014 funding levels account for these needs when the fact that the needs exist suggests that 2014-level funding simply didn’t cut the developmental mustard?

Hmmm …

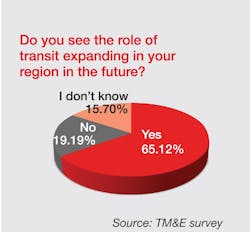

Transit is very important in general. Well, duh. More than 71% of respondents felt their region does not at present have the right balance of transit modes. Yet the yea/nay ratio was 50/50 with regard to the appropriateness of high-speed rail, and bus transit was barely blinked at. How does that jake with the aforementioned concerns over increasing congestion and lack of adequate infrastructure? Highways can’t do it all, can they? More than 75% feel transit—to say mass transit—plays an important role in their region, and 2/3 say it’s a popular way to get around. Why then do 75% of respondents feel less than 1/5 of overall transportation funding ought to go to transit infrastructure development? Perhaps this is a resigned reflection of expectations: 67% said they expect 10% or less to actually go into transit. Most regions won’t be buying ITS equipment, yet those who say they will are targeting those same areas of concern listed above: traffic signal timing, safety improvements, congestion reduction and active traffic management.

There is confidence

More than 60% say they will retain present staffing levels, and another one-third plan to add staff, so there is a solid sense of confidence in what ITS is going to do in 2015. Having said that, one wonders where that confidence lies when highways seem to retain the lion’s share of expected funding, attention and development. It is not to say that roads and bridges are not in desperate shape pretty much everywhere—they certainly are—but will 2015 be the year that a bolder position is held by which there is finally a general declaration that automobile reliance must be curbed for the benefit of an ever-changing world? It remains to be seen.