HNTB study finds Americans pay less for roads, bridges than other utilities

An analysis of available data by HNTB Corp. shows that families pay far less for the nation's transportation infrastructure compared to how much they pay to use critical services such as electricity, water, and broadband.

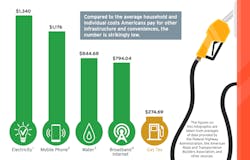

The study found that on average, American drivers pay just $274.69 annually in gas taxes (federal + state taxes) at the pump, the primary source of funding for the upkeep and improvement of U.S. roads and bridges. Compared to other critical public services, the cost for their transportation systems lags far behind. HNTB says that household expenses for annual average electric bills in the U.S. ran $1,340 in 2017 according to the U.S. Energy Administration. Forbes reported that annual broadband internet service totaled $794.04 that year, and Statista reported that a family of four paid an average annual water bill of $844.68 last year. Individually, Americans’ mobile phone bills average nearly $100 a month or $1,200 per year, according to bill pay service Doxo.

“Think of it this way: the bills we pay monthly for critical services like electricity and water largely go to the utility companies and municipalities that provide these services,” John Barton, senior vice president and national DOT practice leader for HNTB, said in a statement. “That is not so when it comes to transportation. Transportation is a utility and should be viewed as such. Mobility providers—the governments that build and maintain roadways, bridges, paths, and transit systems ... see only a fraction of what Americans pay on average at the pump to deliver such an essential service. Typically, less than 20% of what we pay at the pump actually goes to fund our transportation system.”

“The low fuel taxes we pay are simply not enough to maintain our systems, let alone build or improve capacity,” Barton added.

To conduct the study, HNTB reviewed state and federal gas tax data from the American Road and Transportation Builders Association and calculated average gas tax by reviewing most recent (2017) data from the Federal Highway Administration that showed average miles driven in each state, dividing it by the average 2016 miles per gallon for U.S. cars and trucks as reported by the Environmental Protection Agency, and multiplying it by the average total state and federal gas tax.

Looking for additional transportation revenue now, dozens of states across the country are raising gas taxes to help fund mounting transportation infrastructure needs and plan for the future. Even with those taxes, annual vehicle registration and other fees, funding continues to fall short as more efficient automobile engines use less gas and electric vehicles, which are quickly increasing in number, use none.

Conversely, HNTB said, the federal government has not raised its gas tax since 1993, and the Highway Trust Fund is woefully underfunded.

-------

SOURCE: HNTB