Know the Return on Equipment Investment

We work in a very capital-intensive business with razor-thin margins. Ever wondered how it works? Ever wondered whether it was more important to make a profit than to reduce the amount of capital required to accomplish the job?

As with most things, it is a balance. As with most things, success requires excellence in more than one dimension. It is not enough to be profitable; we must also manage capital employed and ensure that it is used as efficiently as possible.

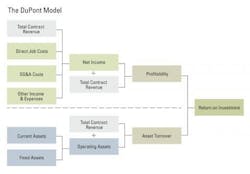

The DuPont model was developed more than a century ago to show how profitability and asset turnover combine to calculate return on investment—one of the most fundamental measures of company performance. The model is as relevant today as it was then, and much can be achieved by understanding how it works and learning what equipment managers can do to improve their company’s performance.

Many variations of the DuPont model are found in practice. Some are more complex than others, and most are heavy in accounting and finance terminology. The diagram at top simplifies the model and illustrates the principles involved using as much construction language as possible. Let’s go through it step by step.

For the full story, please visit: https://www.constructionequipment.com/know-return-equipment-investment