“Kick the can down the road, the can gets bigger.”

City of Joliet, Ill., roadways engineer Michael Eulitz was unequivocal in his summary appraisal of the present construction-industry funding crisis. “We’ve just been putting out fires these last six to seven years. We’d like to be proactive, but we have to just try to get the worst done first—and there’s plenty of bad after that.”

The road and bridgework construction industry is one in which things are all of a part—throw one aspect out of alignment, all others lose balance. So it logically follows that the equipment side of the industry has faced some wobbly ground in calendar 2015.

Or has it?

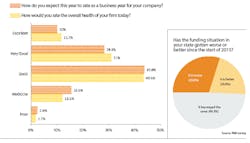

Roads & Bridges’ Mid-year Equipment Survey results were remarkable in their self-contradiction. Two-thirds of companies characterized 2015’s business year as at least “good,” of which nearly 40% saw it as “very good” or “excellent,” and those same companies declared themselves to have—by a 6-to-1 ratio—a “good” or better overall fiscal health. Yet, 33% of those same companies have seen only average performance since Jan. 1, and fully half have seen stagnating funding sources. Optimism doesn’t exist in a vacuum; something must account for this seeming level of confidence.

Al Cervero, vice president of the Construction Equipment Sector at the Association of Equipment Manufacturers (AEM), posited an idea that might shed some light: “The price of oil is probably good right now for road contractors,” he told Roads & Bridges. “Asphalt is at a good price, and fuel costs are better—but you’ve got a lot of energy firms that put a lot of equipment on the market when fracking began to scale down a little bit.”

Which means what?

“I think what we have is a lot of skepticism in the market,” Cervero said. “Despite good labor numbers and the fact that interest rates look to go up, which is all good news. But we’ve got a two-month extension of the highway bill, and states are trying to figure out what they’re going to get—which means contractors are still a question mark, too.”

With a flush of used equipment on the market, married to a downgrading level of confidence in what not a decade ago was a far more predictable industry in terms of the number and consistency of let jobs, a rise in the value of used equipment is as confusing as a smattering of “healthy” companies that see little to no growth.

“We’re seeing an uptick in used equipment value,” Cervero confirmed. “But we’re also seeing an uptick in the length of time equipment is being kept, which says that small- and medium-sized buyers are paying close attention to the specifics of their machines. Folks are adopting, but the larger companies are being more aggressive, in general and with the newer Tier 4 machines.”

When Roads & Bridges asked contractors what type of equipment they were looking to procure by year’s end, a broad spectrum was identified. On-highway trucks (31%), light equipment (23%) and excavators (19%) were the most needed, closely followed by wheel loaders, backhoe loaders and skid steers (all 15%, respectively).

Nonetheless, the most telling reply given was “none” (35%). How to account for this? Simple lack of need? Or is it that more than 41% are facing an up to 10% cost increase to maintain what they’ve already got—and more than 20% are facing costs even higher than that?

A borrower be

Sixty-eight percent of respondents do not plan to rent more equipment than has been usual over the past few years. Yet according to Wells Fargo’s 2015 Construction Industry Forecast, lack of consistent work (65%), the need for project-specific equipment (70%) and the flexibility of returns on rental equipment (53%), along with commensurate cost breaks, are all important factors driving contractors away from major capital investitures and toward the convenience—and perhaps fiscal safety—of renting.

“Rental rates and utilization are up,” Cervero said. “But what that says is that a lot of companies are not confident enough to make a major capital investment [in new equipment]. The rental rate has been inching up for a long time now. In fact, this year at World of Asphalt/AGG1, 24% of the folks we talked to said they are considering renting their equipment on a daily basis. When you ask someone if they’re going to rent their equipment on a daily basis—and that’s their core equipment, mind you—and 24% tell you they’re seriously considering it, it speaks directly to that degree of uncertainty.”

William Schultz, owner of Schultz Construction Inc., in Ballston Spa, N.Y., concurred.

“We’ve had to travel quite a bit farther than we’ve typically had to travel in recent years to get work,” he told Roads & Bridges,. “And we’re seeing less bridge and highway work. The trend for us has been to rent [job to job], and due to the fact that we’re now traveling more and farther for jobs it makes sense to rent locally, rather than to transport our own equipment three to four hours away. We’re renting excavators and front-end loaders, mobile cranes and dozers, and 6-wheel end-ups. A wide range of stuff. We’re not investing in the heavier equipment because [the climate] is just

too unpredictable.”

Not that this is the ideal situation.

“We would prefer to invest in equipment. We would do that if we had predictability, but we just don’t.” Schultz went on, “Eight years ago, we were investing in heavy equipment because we had dependable lead time for consistent types of jobs. That gave us confidence to invest. We could even forecast two to three years out in the markets we serve, but no longer. Lack of funding keeps us from forecasting more than a few months at a time.”

Grain of salt

According to Wells Fargo, distributors are banking on a 70% increase in new equipment sales and a 73% increase in used equipment sales. Well . . . of course they are; what equipment manufacturer is going to publicly declare the expectation of failure? In the same breath, contractors were far more conservative, eyeing 30% and 34% increases, respectively, while leaning more toward stagnation (37% and 46%).

Yet, growth is perceived across the board, and this seems to be bearing out in local pockets, where city and village-level agencies are anticipating a return to pre-recessional levels of productivity.

Eulitz, who oversees all road work and maintenance for the city of Joliet, while adamant about overall infrastructure failures, is optimistic in his fleet’s ability to expand.

“We’ll continue to pay for infrastructure problems at this point for the next 10 years,” Eulitz said, “but over the last couple years we’ve been trying to get back on track with equipment purchases for the department. Before that, in 2006 we bought some trucks, some sweepers. This year we’ll get trucks, chippers and sweepers; this has been the best year for equipment buying for the last 10 years.”

And when your fleet grows, personnel must follow. “I believe we’ll be bulking up a bit with our personnel. Personnel and equipment go hand in hand. It looks like we are headed back to where we were before the recession. We want to get to a proactive stance, rather than a reactive stance.”

Still, all this—good and ill, optimism and uncertainty—should be taken with a grain of salt.

“This is all conversational, mind you,” said Cervero—and perhaps that’s the rub. Uncertainty in the general construction industry has stripped predictability from the equipment market so effectively that the best anyone can do is play guessing games. R&B